Dubai Car Insurance Cost (2026 Guide)

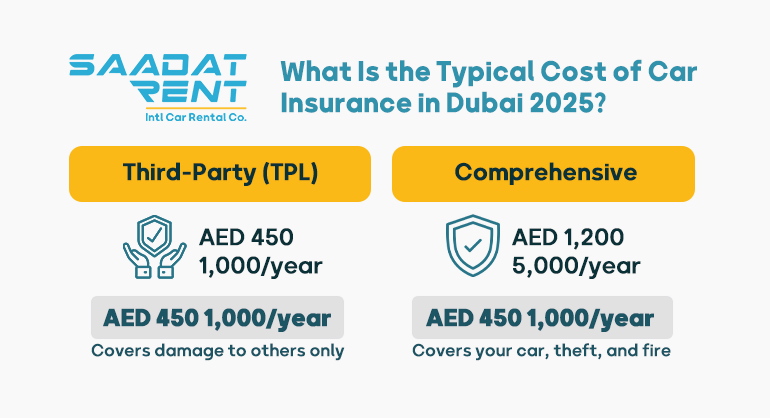

- Required insurance: Third-Party Liability (mandatory) or Comprehensive

- Third-Party Liability (TPL) cost: AED 450–1,000/year

- Comprehensive cost: AED 1,200–5,000+ (depends on car type & value)

- Car type impact: SUVs & luxury cars cost more; small sedans cost less

- Extras: Personal accident, roadside assistance, theft protection

Car Insurance Basics You Should Know in Dubai

Below are some essential questions and answers to help you understand how car insurance works in the UAE.

1- What types of car insurance are available in Dubai?

Third-Party Liability (TPL) and Comprehensive insurance.

2- How much does car insurance cost in Dubai?

- Comprehensive car insurance in Dubai usually costs AED 1,200–5,000 per year.

- Third-party insurance typically ranges from AED 450–1,000 annually.

Prices vary based on car value, driving experience, and coverage type.

3- Does car insurance cover my own car?

Only Comprehensive insurance covers your vehicle; TPL only covers damage to others.

4- Do I need car insurance to drive in Dubai?

Yes. TPL insurance is legally required to drive.

5- Can tourists get car insurance in Dubai?

Yes, rental companies provide insurance, often bundled with the car; upgrades like Loss Damage Waiver add more protection, as mentioned in the article Car Rental Documents for Tourists.

What Is the Typical Cost of Car Insurance in Dubai in 2026?

The type of insurance significantly affects cost. Third-Party Liability (TPL) is the most affordable option, ranging from AED 450–1,000/year. Comprehensive coverage costs AED 1,200–5,000/year and protects your car against damage, theft, and fire. For most vehicles, comprehensive insurance is recommended, typically costing 1.25%–3% of the car’s market value.

| Insurance Type | Annual Cost (AED) | Coverage | Key Notes |

| Third-Party Liability (TPL) | 450–1,000 | Injuries & property damage to others | Legal minimum; does not cover your own car or medical costs |

| Comprehensive | 1,200–5,000+ | TPL + own car protection | Covers damage, theft, fire, natural events; optional extras: personal accident, roadside assistance |

What Is Third-Party Insurance

Third-Party Liability (TPL) insurance in Dubai is the legally required minimum that only pays for injuries and property damage you cause to other people. It does not cover repairs to your own rental car in Dubai or your medical costs if you are at fault.

What Is Comprehensive Insurance

Comprehensive insurance usually bundles third-party cover with protection for damage to your own vehicle, theft, fire, and many natural events. It can include extras like personal accident cover and roadside assistance.

Top Factors That Can Affect Your Insurance Cost

Some factors, like vehicle model, your age, and location, can definitely drive up or down the Dubai car insurance cost. Let’s explore these factors in more detail:

1- Vehicle Value & Type

The cost of comprehensive insurance is not fixed and varies based on your car’s model and market value.

| Car Market Value (IDV) | Estimated Premium Rate | Example Premium |

| Less than AED 100,000 | 2.5% to 3.25% | AED 50,000 car about AED 1,625 |

| AED 100,000 to AED 300,000 | 2.2% to 3.0% | AED 180,000 car about AED 4,500 |

| Over AED 300,000 (Luxury) | 2.2% to 2.75% | AED 350,000 car about AED 8,500 |

Car type matters:

Insurance premiums in Dubai vary significantly based on the type and value of your vehicle:

- Small sedan (1.6L): AED 1,200–1,600/year

- Average SUV: AED 1,800–2,700/year

- Luxury models: AED 4,000–7,500+

- High-end sports cars: AED 7,000–30,000+

2- Driver’s Profile

Drivers under 25 typically pay 3–7% of their car’s value, compared to 2–4% for more experienced drivers. This gap exists because Dubai traffic fines data show that drivers aged 17–25 are involved in nearly half of fatal accidents, increasing their risk profile.

New license holders face an additional 25% surcharge, and drivers aged 23–25 often see another 25% increase added to their base premium.

Note: These percentages are not fixed and may vary based on the insurance provider.

3- Location

- Busy urban areas (e.g., Downtown Dubai, Marina) tend to have higher premiums due to more traffic, accidents, and theft risk.

- Quieter, low-claim neighborhoods with secure parking (e.g., Al Barsha, Jumeirah Village) generally see lower premiums.

Note: Exact price impact varies by insurer and is not standardized.

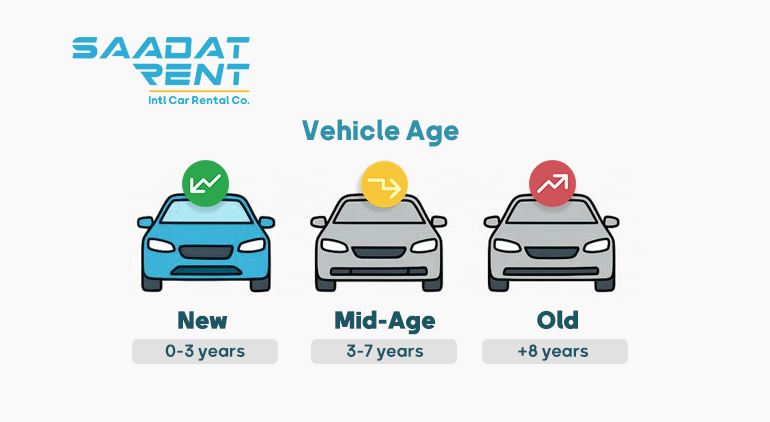

4- Vehicle Age

- Newer cars (0–3 years) often have higher premiums due to full replacement value and expensive parts.

- Mid-age vehicles (3–7 years) usually offer a balance of lower risk and repair costs.

- Older cars (8+ years) may have lower premiums because depreciation reduces payout exposure.

5- Policy Design and Optional Add-ons

Common add-ons include roadside assistance, personal accident cover (~AED 120 for the driver), passenger coverage (~AED 30 per additional passenger), and rental car coverage during repairs.

6. Discounts & Penalties

- No-Claim Discount (NCD): Maintaining a clean driving record may reduce premiums.

- Security features: parking in Dubai in secure areas or having anti-theft devices can lower premiums slightly.

- Penalties: at-fault claims or traffic violations may increase premiums, depending on the insurer’s policy.

For more details on the Cost of Living in Dubai, click here to read our full guide

How to Legally Reduce Your Car Insurance Premium in Dubai

- Remove unnecessary add-ons: Extras like roadside assistance, rental car replacement, and off-road coverage can raise premiums. Keeping only what you truly need helps cut costs.

- Keep a clean driving record: Accidents and traffic violations increase premiums. Completing a defensive driving course after a violation may help reduce future rate hikes.

- Use no-claim bonuses (NCB): UAE regulations allow 10% off after 1 claim-free year, 15% after 2 years, and 20% after 3 years. Some insurers offer up to 30% for long-term safe drivers.

- Choose third-party coverage for older cars: For older, low-value vehicles, Third-Party Liability (starting around AED 630) is often more cost-effective than comprehensive insurance.

- Compare insurers before renewing: Rates vary widely between companies. Using online comparison tools helps you find better prices for the same coverage.

Common Pitfalls & FAQ for Renters

Are there hidden insurance costs I should know about?

Yes. High deductibles/excess amounts, administrative fees, and coverage gaps (tires, windshields, interiors, undercarriage) can lead to unexpected expenses.

What is the difference between excess and deductible?

Both refer to the amount you pay before insurance covers damages. Typical ranges: AED 1,000–5,000 depending on vehicle and coverage. Optional Super CDW or Zero Excess policies lower this, but may increase your daily premium.

Is rental company insurance enough?

Basic rental insurance covers Third-Party Liability (TPL) and minimal vehicle damage. It often excludes personal accident coverage, tires, windshields, and some other damages.

What happens when I return the car?

Deposits (AED 1,000–5,000) are held for fines, tolls, or damages. After inspection, the deposit is released. Any damage may require payment up to the excess amount.

Can I drive a rental car across borders?

Standard UAE rental insurance covers only UAE roads. Cross-border travel requires a No Objection Certificate (NOC) and extra coverage, typically AED 20–100/day.

Are there age restrictions for renting?

Yes. Most companies require 21+, while renting luxury cars in Dubai often requires 25+. Drivers under 25 may pay AED 50–200/day or face rental denial.

How can I reduce rental insurance costs?

Compare quotes, maintain a No-Claim Discount (NCD), use anti-theft devices, choose higher deductibles, or bundle coverage with long-term rentals.

What damages are usually not covered?

Common exclusions: tires, windshields, interiors, undercarriage, off-road use, and reckless driving incidents.

Reduce Insurance Costs & Drive Safely in Dubai

Don’t forget that transparency and informed comparison are the keys to saving money when it comes to Dubai car insurance costs. Flood damage, higher repair costs, and young-driver risks all play a big role in these increases in car insurance costs in Dubai. With a bit of attention, you can still save a good amount on your insurance.

If you’re renting a car in Dubai and want to choose the right insurance, Saadatrent follows the same approach in its services, clear pricing, and honest guidance, so you can make confident, cost-efficient decisions whether you’re renting a car or choosing the right insurance.